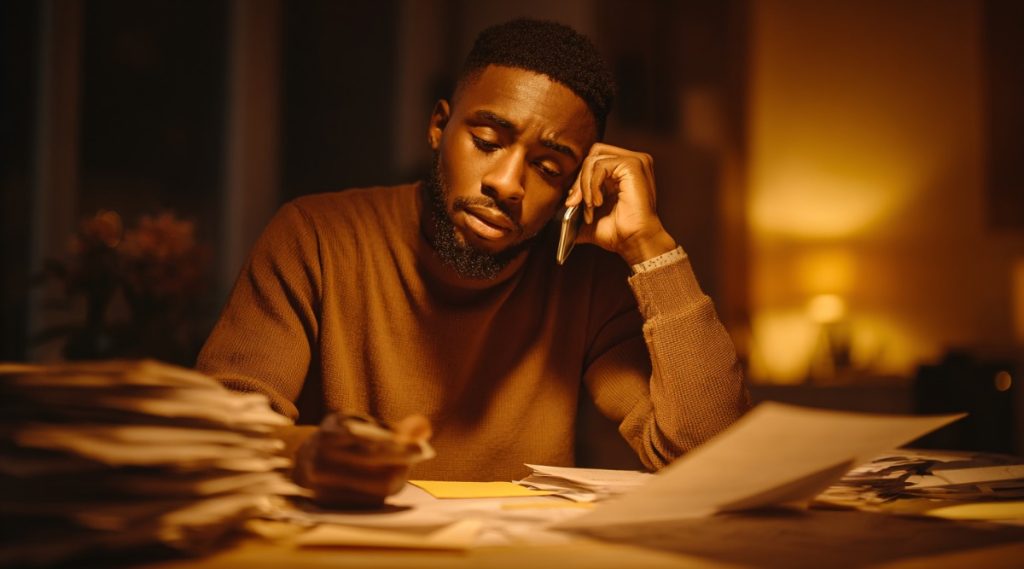

Debt problems rarely arrive quietly. For families in Elfers and across Pasco County, it often starts with a single collection call. Soon, the phone rings constantly. Collectors may call your workplace, threaten lawsuits, or even pursue debts that aren’t yours. In many cases, the information they use is incomplete, inaccurate, or outright false—but that doesn’t stop them from trying to collect.

Credit reporting errors make matters worse, damaging your score, raising your interest rates, and limiting your financial opportunities. Meanwhile, lawsuits can appear without warning, with collectors hoping you’ll feel too overwhelmed or ashamed to fight back. They rely on fear, confusion, and silence to win by default.

We believe no one in should lose their paycheck, their home, or their peace of mind because of unlawful or abusive debt practices. Everyone deserves strong legal defense and a clear path forward.